Over the next decade, Western countries in general are expected to see slower consumption growth. Where will growth come from as Western countries' consumption fades? Will we face another recession soon? Find out where our robot, Athena, thinks the answers are and contact us to order a customized and full 40-60 page briefing.

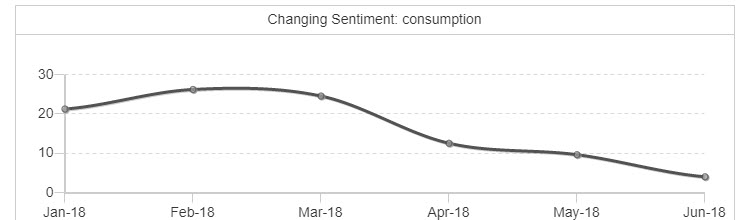

consumption

- Tough times are expected to continue in 2018 as IDC forecasts consumption in China to decline another 7.1% before flattening out in 2019.

- Investment in nuclear power and renewable energy will likely lead to much lower rates of abstraction and consumption by 2050.

- Consumption of plastic fuel tanks was secured at 79,054.6 units in 2017 and is expected to reach nearly 128,350.0 units by 2025 end.

- In the global rice market, 2018/19 production, consumption, and trade are all projected to be record high.

- In Sub-Saharan Africa, rice production, consumption, and imports are all projected to be larger in 2019 than in 2018.

- In China, e-commerce currently accounts for 15% of consumption and is projected to account for more than 40% of growth in consumption through 2020.

- Growth in ASEAN is projected to stay at 5.3 percent both this year and next, reflecting strong investment and consumption across several countries.

- The consumption of petrol is projected to rise by 10% by the end of the financial year 2017-2018 in Delhi.

- Australia's GDP growth is expected to strengthen a little over the next year or so as the drag from mining investment comes to an end and accommodative monetary policy provides ongoing support for sustained growth in household income and consumption.

- Poland Logistics Market will be Driven by Increasing Consumption.

region

- Europe is expected to be a significant revenue generating region during forecast period.

- By 2020, the highest demand for penoxsulam will come from the Asia Pacific region.

- Asia Pacific region accounted for the largest soaps and detergents market share due to huge domestic consumption of aroma chemicals in India.

- India can look at importing scrap from highly developed regions that are forecast to see declining proportional castings consumption.

energy

- By the year 2050 Americans will get about 16 percent of their energy from renewables.

- Renewable energy could represent between 46% and 69% of final energy demand in 2050.

- Investment in nuclear power and renewable energy will likely lead to much lower rates of abstraction and consumption by 2050.

- 2018 Hopes are high that removing fossil fuel subsidies could help to mitigate climate change by discouraging inefficient energy consumption and levelling the playing field for renewable energy.

- By 2020, 100 percent of JPMorgan Chase's global energy needs will be sourced by renewable power like solar and wind.

demand

- The global LNG market is expected to grow with rising energy consumption, growing urban population, increasing demand of natural gas vehicles, accelerating economic growth and increasing preference of LNG in developing economies.

- The need for low power consumption and improved efficiency is expected to generate continuous demand motors demand over the next few years.

- With global consumption expected to grow by only 1 percent from last season, the stocks-to-use ratio for wheat (a measure of supply relative to demand) is forecast to advance to 36.5 percent, a three-decade high.

- Renewable energy could represent between 46% and 69% of final energy demand in 2050.

- World oil production and consumption leader China will see flat demand this year.

- Electricity is projected to make up 40% of all world energy consumption by 2040 with SE Asia accounting for two-thirds of future global energy demand largely due to an emerging urban middle class.

emission

- China's milk consumption will increase threefold by 2050 - a major shift that could increase global greenhouse gas emissions from cows by more than one-third

- Switching to a plant-heavy diet could save the US up to $80 billion, the study shows, by averting greenhouse gas emissions and the national cost of health problems that stem from unhealthy diets.

market

- The Asia-Pacific market is expected to encompass upcoming production capacities of vinyl acetate monomer, purified terephthalic acid, ester solvents, and acetic anhydride.

- The rapid increase in the industrialization in China, India, and Japan is predicted to propel the country level market of vacuum packaging.

- Asia Pacific region accounted for the largest soaps and detergents market share due to huge domestic consumption of aroma chemicals in India.

- Asia-Pacific is expected to be an emerging market during the forecast period with the increasing provision of subsidies by the Indian and Chinese governments to help in food sustainability.

- Going forward, China is expected to continue to play a key role in global metals markets, as it accounts for more than 50 percent of world metal consumption.

- In the global rice market, 2018/19 production, consumption, and trade are all projected to be record high.

price

- Arabica prices are forecast to average $3.25 / kg this year.

- Coal prices are expected to average $85 /mt in 2018, down slightly from 2017, as inventories are replenished and consumption is curtailed.

- With Detroit increasingly offering U.S. consumers high profit margin, gas-guzzling SUVs, high oil prices could be problematical for American car makers.

- Precious metals prices are projected to rise 3 percent in 2018, but with some divergence.

- Colombia will see an uptick in real GDP growth in 2018 due to stronger private consumption, rising oil prices and increased investment.

- Steelmakers through EAF route should expect more turbulence over the year ahead on account of further dwindling supplies of Graphite Electrodes and soaring prices.

growth

- The pace of growth in US personal consumption will remain at about 2.6 percent during the year ahead.

- In China, e-commerce currently accounts for 15% of consumption and is projected to account for more than 40% of growth in consumption through 2020.

- Growth in ASEAN is projected to stay at 5.3 percent both this year and next, reflecting strong investment and consumption across several countries.

- Growth will rebound in 2018 in Colombia, as private consumption picks up following a significant decline in 2017 and investment flows into the oil and infrastructure sectors.

- A private consumption rebound will be Colombia's main pillar of growth in 2018.

- Based on strong domestic US steel demand fundamentals and customer optimism, price momentum and growth in steel consumption will continue during the year.

- Recent U.S. Federal Administration steel trade actions will result in reduced imports during the year, and tax reform will provide a stimulus for additional domestic fixed asset investment and growth.

tonnage

- India's consumption is projected to increase 0.7 percent to 98.0 million tons.

- Thailand's 2018/19 rice consumption is projected to drop 10.5 percent to 10.0 million tons as sales of low-quality government stocks for feed and industrial uses are expected to be completed.

- PCA expects cement consumption to grow to 640 thousand metric tons by 2040 compared to an average of 540 thousand metric tons historically.

- Under PCA's baseline US scenario, annual cement consumption for rail ties will reach 51 thousand metric tons by 2040.

- PCA expects railway bridge cement consumption to reach 249,000 metric tons by 2040.

- PCA projects the high scenario for US railway cement consumption to reach 736,000 metric tons by 2040.

source

- Existing hardware combined with renewable energy sources will not affect the world's energy consumption all that much.

- By 2030, 50% of total electric power generation will be from non-fossil energy sources.

rate

- Electrical consumption is expected to grow at an annualized rate of 0.5% over the five years to 2023.

- China's electricity consumption will maintain a growth rate of 7.2% and above between 2011 and 2020.

- Global oil consumption-weighted gross domestic product growth for 2018 will be at its highest rate since 2012.

- Investment in nuclear power and renewable energy will likely lead to much lower rates of abstraction and consumption by 2050.

- Further investment in nuclear power and renewable energy sources will inevitably lead to lower abstraction rates and water consumption by 2050.

Do contact us to see how we can help you track future energy developments as they are announced or reported.

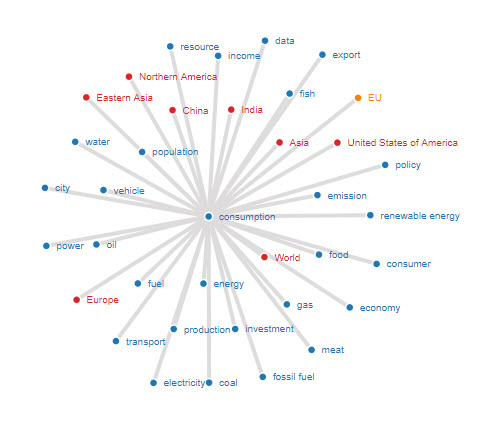

Systems map

Future consumption growth is most likely to come from Asia's rising middle class and population increases. China and India will lead the charge. Demand for energy, better vehicles and food are likely to be key markets in Asia.

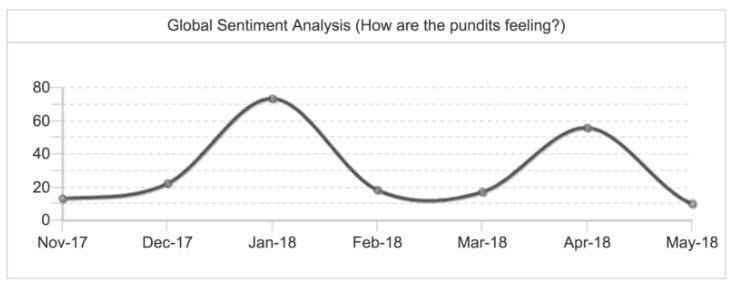

Sentiment analysis

Global Sentiment is a coincident Indicator of emerging change. As pictured below it analyzes the mood of the pundits who are reporting on the future. Since pundits generally reflect the mood of society and change society's opinions it is a good indicator of people's current view of the future.

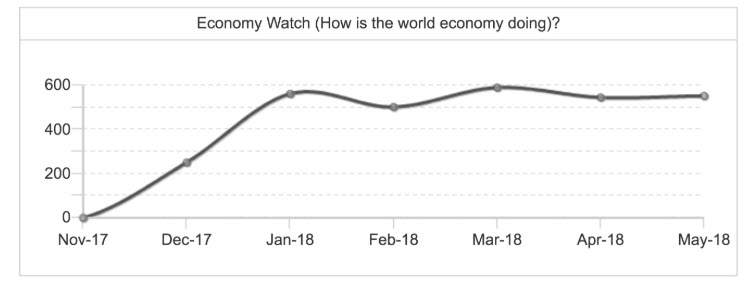

Economy Watch is a lagging indicator of emerging change. It auto-aggregates opinions of our 20,000+ sources on whether the global economy is likely to grow or decline soon. Get a fast, up to the minute, handle on global optimism or pessimism and act as you see fit.

VUCA World is a leading indicator of emerging change. It describes whether reported volatility, uncertainty, complexity and ambiguity of general global current conditions and situations is getting better or worse. Movements up or down in this graph generally presage the same effect in the other two charts presented here, over time. Get a fast, up to the minute, handle on global optimism or pessimism and act as you see fit.

Athena reports that pundit and expert sentiment towards future growth has slowed in the last four months. Although global economic uncertainty is stable uncertainty has dropped precipitously since March of this year.

Sentiment could shift rapidly if a clear and present geopolitical event, caused by a paucity of international leadership and diplomacy shocks the markets. This coupled with the high-risk combination of record debt, asset bubbles, low growth, potential trade wars, and limited scope for action could see the global economy spiral into a new crisis. We place the probability as high as 50%: up from 25% in January 2017. A correction could come as soon as this year but more likely 2019. Time to build scenarios and determine your course of action in each scenario we think.

Pie charts

Athena considers that the switch from Western to Asian economies will take another generation for the tipping point to be reached and for there to be a dramatic switch in wealth from West to East, but the emerging signals are now evolving and gaining traction.

Radar

The top ten sectors that will likely be most effected by emerging change are Retail, Food & Agriculture, Support Services, Telecoms., Government, Energy, Financial Services, Healthcare, Manufacturing and Construction.

Sources

Athena used the sources below as the top ones to create this report and determined which embedded forecasts are included in this Trend Alert. She found 6,618 forecasts in seconds on 5th June 2018 to allow us to publish this summary in less than an hour. She can turn these into PowerPoint slides and Audio files in minutes too as you wish, or we can prepare a full customized and professionally written brief for you to order covering all 6,618 forecasts.

Athena

Athena does show duplicates to aid your understanding of themes as well as contradictory forecasts. She may also show near-duplicates. You can speed read past the duplicates and near-duplicates if you wish, though the latter may show additional information. You can use the contradictory, and likely uncertain forecasts she finds to imagine different scenarios. The future is unpredictable, but we can examine the possibilities and choose our preferable future from the choices she presents.

Athena is apolitical. She will report forecasts from different viewpoints however distasteful that might be to our own values. Wearing rose-colored glasses is not her purpose; reporting potential futures is. So, we recommend you check her veracity before responding to her extracted forecasts.

Just like humans, Athena can be fallible. Do recognize that you and your associates are biased too. But whereas you tire, make mistakes and only recognize what interests you, she does not. She might miss or misinterpret as you do, but with far less frequency and she'll take uncomfortable truths and alternative ideas in her stride. But, please let us know if you feel her bias can be reduced. We want to do our best for you. And, as with any research, you should check and triangulate her findings for yourself.

Keep up to date: You can stay bang up to date on this topic or choose from our many automatic reports to determine what's next in seconds.

Global goals | Social changes | Sector prospects | Risks & opportunities | Year-by year | G20 watch | Key Organizations

You can also ask us to set-up private topics for you (clients only) to achieve the same thing as this Trend Alert for your associates or set up Email subscriptions (Registration required) on your favorite subjects.