Amazon represents a real threat to many businesses and an opportunity to learn, Read on to see the forecasts that our robot, Athena, has found on its likely future activities and act accordingly. There will be no hiding place in the markets that Amazon chooses to dominate as the book stores found out to their belated cost. Make sure you are ready.

- Amazon

- Amazon will now be able to analyze trends on the hyper-local level, calibrating supply and demand on a store-by-store basis and further eliminating waste.

- A big challenge for Amazon will be applying its logistics know-how regarding durable, long-lasting products like books, toys and tablets to delicate perishables like strawberries and steaks that have to be handled gingerly.

- Amazon will win the battle against Wal-Mart by winning with fresh food.

- Amazon will soon carry all of the 365-branded products Whole Foods has developed and all Whole Foods stores will be adding aisles for garden equipment, household electronics, sportswear.

- Many have speculated that one day Amazon will not need to rely on UPS, FedEX, or the Postal Service to deliver stuff.

- A patent filed by Amazon outlines the company's vision for vertical drone delivery hives that could be destined for urban centers.

- Grocery shopping will increase the frequency of buying on Amazon.

- Amazon will be able to push better discounts for Whole Foods customers through Amazon Prime.

- Amazon will use Whole Foods stores as a proving ground for its many innovations like Amazon Go.

- Amazon will use and improve the Whole Foods distribution assets.

- Amazon won a patent for an on-demand clothing manufacturing warehouse indicating that the company could wade deeper into developing its own apparel.

- Amazon will soon enable lots of new retail experiences.

- Amazon has launched a tool that lets developers easily integrate their connected cameras with Alexa so expect to see even more devices support Echo Show in the future.

- The drop in grocer share prices the day the deal was announced demonstrates the threat investors feel Amazon poses to traditional grocery chains.

- Amazon will not have immediate access to a rich customer data set.

- Buying Whole Foods will enable Amazon to leverage and amplify the extraordinary power it enjoys in online markets and delivery.

- Amazon will acquire 400+ prime location distribution hubs in the US which will enable it to expand its online food offering at pace.

- E-commerce and Amazon threaten far more jobs.

- Amazon will likely build on current multi-channel, technology and hybrid innovations and consumer behaviors.

- Amazon could use Whole Foods stores to market its own electronics and products.

- A successful merger of Amazon and Whole Foods will likely be a mixed bag for the sustainable food movement in America.

- Food companies themselves slumped because of investor concerns that Amazon will do for their products what it does for everything else.

- There has already been speculation that Amazon could use Whole Foods' brick-and-mortar stores to aid in its distribution network for rapid delivery through its local truck fleet and potentially drones.

- Amazon is the tech giant most likely to become a dominant player in fintech.

- Google and Amazon are using network effects to amass fortresses of data that will fend off competitors for generations to come.

- Amazon could offer more bank-like services in future.

- Amazon will undoubtedly pull potential customers and existing Instacart customers over to Amazon Fresh.

- The deal with Whole Foods suggested that Amazon could now look to buy supermarket chains in its major markets which include the UK, France and Germany.

- Amazon could use the local Whole Foods stores across the country to quickly expand its Fresh delivery service.

- The laboratory for Amazon's grocery experiment is now global-in most any city where Amazon has a fulfillment center it will be able to deliver groceries.

- Amazon could well have begun transforming the way people around the world get their food.

- Adding Whole Foods' selection of items to its service could give Amazon a competitive edge against Google.

- Experts expect the discounting to increase as Amazon becomes more aggressive in clothing sales.

- Companies like JB Hi-Fi are very dominant, and profitable retailers in Australia with leverage to population growth and housing will be well placed when Amazon begins to operate.

- Amazon is reportedly weighing up a potential partnership that could see it sell cars to UK consumers via its website.

- The arrival of Amazon to the UK high street poses a major threat to British supermarket operators like Tesco and Sainsbury's.

- Rumors that Amazon will sell prescription drugs continue to circulate.

- Retailers will struggle to win over customers from Amazon.

- One Click Retail's Health & Personal Care report reveals that Amazon is the best growth opportunity for HPC brands.

- Intel is using Curie to build a smartwatch assistant that's landing on Tag Heuer smartwatches later this year before being adopted by other devices as well and could see Intel enter the space that's already pretty crowded with Amazon.

- Amazon is expecting to get the go-ahead from India's government to build a nationwide grocery delivery network.

- Amazon could potentially expand Prime membership dramatically and steal sales from low-price competitors like Walmart.

- Big tech players like Microsoft, Google and Amazon are already investigating the role they will play in the new blockchain economy.

- Amazon, Apple, and countless others are soon expected to throw their hats into the live TV streaming ring as well.

- The Whole Foods 365 brand could be one of the greatest short-term assets to benefit Amazon.

- Wall Street is betting Amazon (AMZN, Tech30) could be as disruptive to the $800 billion grocery industry as it has already proved to be for brick-and-mortar retail businesses.

- The company's sensor-packed Amazon Go convenience stores will not even have cashiers.

- Taking a tougher line on mergers and acquisitions will not necessarily be enough to combat the rising power of giants like Amazon.

- Online behemoth Amazon is predicted to take 3% of the UK's grocery market by 2020.

- The entry of Alibaba in cloud computing in India will add to the fierce competition in the country which already has players like Amazon and Microsoft.

- Major brick and mortar stores will have to step their offline game up in order to compete with ecommerce giant Amazon.

- Service

- Adding Whole Foods' selection of items to its service could give Amazon a competitive edge against Google.

- Amazon Grocery Services will be well-placed to start supplying restaurants too.

- 66.5 percent (or 68 percent of all cloud-based compute workloads) will be in public-cloud spaces such as Amazon Web Services and Microsoft Azure.

- Amazon could use the local Whole Foods stores across the country to quickly expand its Fresh delivery service.

- Paying for TV content from on-demand digital video services will grow by more than 30% to £1.42bn at the turn of the decade.

- Many have speculated that one day Amazon will not need to rely on UPS, FedEX, or the Postal Service to deliver stuff.

- Amazon could offer more bank-like services in future.

- Amazon prime

- Amazon will be able to push better discounts for Whole Foods customers through Amazon Prime.

- Amazon Prime is expected to overtake the country's cinema industry in terms of annual revenue by 2019.

- A new price break on Amazon Prime will go to customers receiving food stamps and other government assistance.

- Amazon echo

- Apple could be about to reveal a Siri-powered speaker to rival the Amazon Echo and Google Home.

- Ford have even gone as far as to announce that some of its cars will use Amazon Echo and the virtual assistant Alexa.

- Amazon today launched a tool that lets developers easily integrate their connected cameras with Alexa so expect to see even more devices support Echo Show in the future.

- Amazon war chest

- Amazon's war chest and online strength could force grocers to cut costs and spend heavily on e-commerce.

- Device

- Ikea's low-cost TRÅDFRI smart lights first announced in Europe last year will soon get voice control for owners of Google Home, Apple HomeKit, and Amazon Alexa devices.

- Customers with an Alexa-enabled device will be able to use it to arm and disarm their alarms and even access their smart devices using Alexa's voice recognition.

- Deal

- The drop in grocer share prices the day the Whole Foods deal was announced demonstrates the threat investors feel Amazon poses to traditional grocery chains.

- The deal with Whole Foods suggested that Amazon could now look to buy supermarket chains in its major markets which include the UK, France and Germany.

- Amazon deal for Whole Foods could bring retail experiments.

- Growth

- AI will be a huge part of Amazon's growth over the coming years.

- Companies like JB Hi-Fi are very dominant, and profitable retailers in Australia with leverage to population growth and housing will be well placed when Amazon begins to operate.

- Hub

- Employing self-driving vehicles to move and organize items at Amazon hubs could let human employees focus on more important matters.

- The more than 460 Whole Foods stores in the U.S., Canada and the United Kingdom could be turned into distribution hubs.

- Amazon will acquire 400+ prime location distribution hubs in the US which will enable it to expand its online food offering at pace.

- Access

- The Whole Foods business will give Amazon access to a premium customer base who shop for organic groceries.

- Amazon will not have immediate access to a rich customer data set.

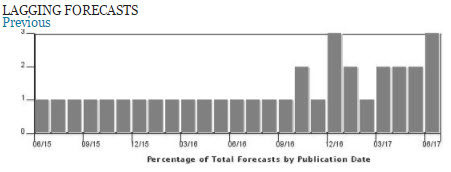

Trend

Amazon’s trend line has increased in recent months due to the new activities reported above. We can expect their trend line to accelerate further as they extend into more markets and geographies.

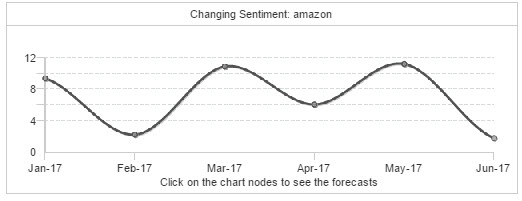

Sentiment Analysis

Amazon has always had a positive overall sentiment curve though fears are now creeping in as to their possible impact on jobs around the world hence the graph’s bumpy ride over the last few months.

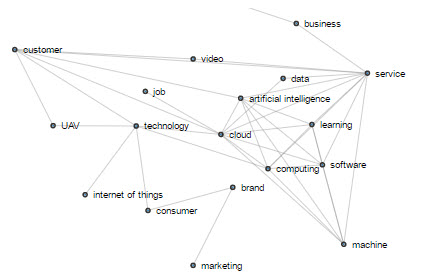

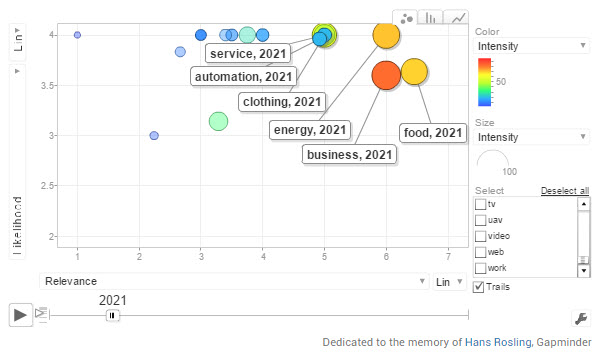

Topic map

The topic map gives you some clues as to where Amazon is building its strengths. Can you learn from Amazon here by exploring their strategies?

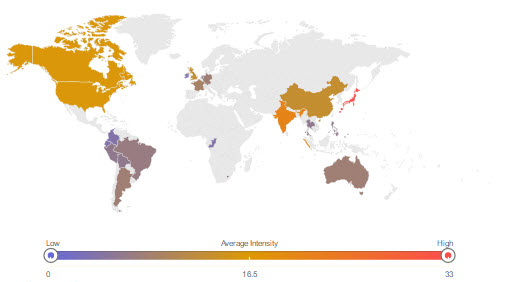

Heat map

There’s a clear medium-term opportunity map showing Amazon’s targets as shown by the coloured countries. But that doesn’t mean Amazon hasn’t got its eyes on the rest of the world. Expect more countries and regions to be attacked by Amazon in the future, particularly in Europe and Asia.

Graphit

By 2020, Amazon could be really disrupting and changing the way US, European and Australian (perhaps also India and China?) consumers buy food and clothing. How will your sector and your organization cope? Contact us to discover how other companies are responding to this huge challenge.

Athena: Our robot, has determined which forecasts should be included in this Trend Alert. She found 1,278 forecasts in a fraction of a second to allow us to publish this summary in less than thirty minutes. She can turn these into PowerPoint slides and Audio files in minutes too as you wish.

Athena does show duplicates to aid your understanding of themes as well as contradictory forecasts. She may also show near-duplicates. You can speed read past the duplicates and near-duplicates if you wish, though the latter may show additional information. You can use the contradictory, and likely uncertain forecasts she finds to imagine different scenarios. The future is unpredictable but we can help you to examine the possibilities and choose your preferable future from the choices she presents. Do contact us to find out how Athena can create instant, powerful and challenging scenarios.

Keep up to date: You can stay bang up to date on this topic or choose from our many automatic reports to determine what’s next in seconds.

Social changes | Sector prospects | Risks & opportunities | Year-by year | G20 watch | Key Organizations

You can also ask us to set-up private topics for you (clients only) to achieve the same thing as this Trend Alert for your associates or set up Email subscriptions (Registration required) on your favourite subjects.