Hidden Currents: The Rise of Environmental Migration Filtering through Urban Infrastructure Investment as a Structural Inflection in Global Migration Dynamics

Migration and mobility patterns globally are widely acknowledged to be shifting due to climate change, geopolitical risks, and evolving socio-economic conditions. However, a genuinely non-obvious weak signal emerging from current analyses is the coupling of environmental migration with targeted infrastructure investments that shape the absorptive capacity of specific urban centers. This phenomenon—exemplified by proactive water supply expansions in rapidly growing urban hubs exposed to climatic pressures—suggests a new form of migration filtering that could significantly alter the geography and governance of migration flows within the next 10–20 years. This signal is under-recognized yet has the potential to reconfigure capital allocation, regulatory frameworks, urban-industrial structures, and strategic positioning at local, national, and international scales.

Signal Identification

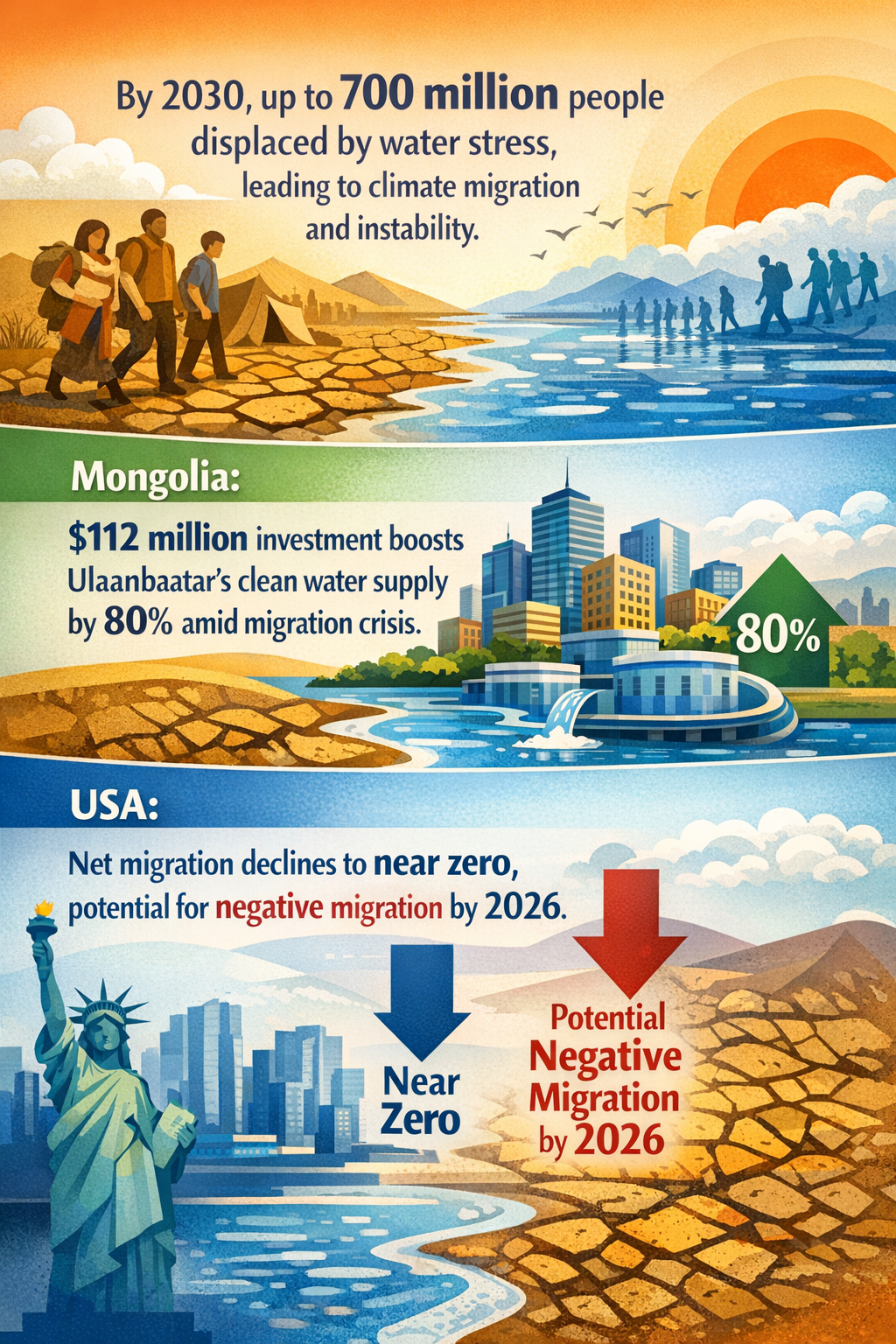

This development qualifies as an emerging inflection indicator because it captures an early-stage but accelerating feedback loop between climate-induced migration drivers and infrastructure-led migration governance. Unlike widely discussed mass displacement scenarios or border security measures, this trend focuses on how targeted investments—such as Mongolia’s $112 million clean water project addressing rural-to-urban migration in Ulaanbaatar—function as deliberate nodal controllers of migration by enhancing urban carrying capacity (The Diplomat 2026/02). With a medium plausibility band over a 10–20 year horizon, exposed sectors include urban infrastructure development, water resource management, housing and real estate markets, public services, migration governance, and climate risk insurance.

What Is Changing

Climate change continues to exert pressure on populations through worsening water scarcity, which the Boston College Center illustrates could displace up to 700 million people by 2030, potentially triggering climate migration, geopolitical instability, and humanitarian emergencies (Boston College CCC 2026/01). This high-level displacement risk is widely recognized, but what attracts less attention is the differentiated capacity of urban centers to absorb such migrants, mediated by strategic investment decisions in urban infrastructure.

In Mongolia’s example, a significant $112 million co-investment aims to increase clean water access by up to 80% in Ulaanbaatar, counteracting the chronic collapse of local resources driven by explosive rural-to-urban migration (The Diplomat 2026/02). This suggests a targeted approach where investment in critical infrastructure effectively gates migration flows by expanding the city’s ability to function as a destination, thus influencing migration volume, composition, and temporality.

Additionally, geopolitical shocks—such as potential refugee crises stemming from conflicts in resource-sensitive regions like the Gulf or Iran—highlight how such influxes might compound urban stress and necessitate corresponding infrastructure adaptations (The Atlantic 2026/02). Conversely, policy and enforcement shifts (e.g., targeted ICE operations in Ohio focusing on Haitian migrants) reveal a parallel trajectory of migration filtering via enforcement but with far less efficacy in shaping urban absorptive capacity (The Week 2026/01).

Across these developments, a recurring, under-acknowledged structural shift appears: migration is not solely a function of push factors like climate shock or conflict, but significantly modulated by infrastructure-enabled urban receptivity—effectively creating “migration corridors” defined by resource and service capacities that evolve alongside capital allocation decisions.

Disruption Pathway

This signal could plausibly evolve into structural change as follows. First, increasing climate-driven rural displacement will generate sustained pressure on urban centers globally, especially in developing regions where infrastructure deficits currently maximize migration drag effects. As governments and international partners prioritize selective infrastructure investments—particularly in water, housing, sanitation, and energy—these interventions will not merely accommodate migrants but actively shape migratory flows by defining which cities can absorb growing populations effectively.

Amplifiers include: international climate adaptation funding channeled to strategic urban infrastructure projects; public-private partnerships focusing on “migration buffer zones”; and innovations in urban resource management technologies that optimize capacity under scarcity. Another acceleration factor may be the geopolitical instrumentalization of infrastructure investments as leverage points in competition for influence over migratory demographics.

The resulting stresses include acute disparities in city-level absorptive capacities, compelling migration routes to reroute toward better-resourced hubs, creating new insecurities in traditional migration destinations while exacerbating urban congestion in others. Therefore, traditional push-pull or border-centric migration management paradigms may fracture, requiring regulatory frameworks to evolve toward integrated urban infrastructure and demographic governance strategies.

Structurally, this could drive a reconfiguration of industrial and governance models by elevating the importance of climate-resilient urban planning, multisectoral capital deployment portfolios skewed toward infrastructure-as-migration-policy, and novel cross-jurisdictional regulatory regimes orchestrating migration flows via infrastructure standards and investment conditionalities. This reorientation may also catalyze financial innovations such as migration-linked municipal bonds or catastrophe insurance indexed to urban absorptive stress.

Why This Matters

From a decision-making perspective, this insight exposes a latent lever for modulating migration dynamics that is neither purely coercive nor strictly humanitarian but infrastructurally strategic. Capital allocation strategies in urban development and climate adaptation could pivot to prioritize infrastructure projects as primary migration governance tools, shifting investment risk profiles and valuation criteria.

Regulatory implications include the need for governance frameworks that integrate migration impact assessments into urban infrastructure approvals, potentially creating new cross-sector regulatory bodies. For industrial players—construction, utilities, technology providers—there may be emergent competitive advantages for those with capabilities aligned to migration-modulating infrastructure.

Supply chains may also be impacted, as cities with expanded absorptive capacity demand more building materials, water technologies, and energy solutions. Equally, governance liabilities will surface as inadequate or delayed infrastructure investments could catalyze cascading humanitarian crises, compelling governments to internalize migration-related externalities previously managed by border or aid policies.

Implications

This signal may reshape global migration management over the next two decades by embedding migration flows within infrastructure investment decisions, moving governance upstream from borders to urban resource provisioning. It could enable more proactive migration filtering that is less visible and more durable than enforcement-centric strategies.

It is unlikely to fully replace political, economic, or conflict drivers of migration but could reorient their impact through selective absorptive capacities. Competing interpretations could view this as merely a local adaptation rather than a systemic inflection; however, the global scale of climate migration pressures suggests scalability.

Furthermore, this development might also amplify inequalities between cities and regions based on their infrastructure investment access, creating new geopolitical fault lines in migration governance and urban competition.

Early Indicators to Monitor

- Announcements and funding allocations targeting urban clean water, housing, and energy projects explicitly linked to migration management goals.

- Formation of cross-sector coalitions or public-private partnerships framing infrastructure as migration governance.

- Emerging regulatory frameworks integrating migration impact assessments into urban development approvals.

- Pilot projects reporting shifts in migration inflows correlated with infrastructure upgrades.

- Venture or impact investment trends focusing on urban resource technologies designed for high-migration environments.

- Government announcements coupling climate adaptation funds with urban absorptive capacity metrics.

Disconfirming Signals

- Continued prioritization of border enforcement and deterrence policies with declining attention or funding for infrastructure-based migration management.

- Major failures or delays in delivering infrastructure projects in key urban migration hubs, resulting in migration patterns unaffected by capacity enhancements.

- Climatic or geopolitical shocks overwhelming even improved urban infrastructure, rendering absorptive enhancements irrelevant.

- Emergence of widely adopted migration technologies or policies that bypass physical infrastructure constraints, e.g., digital asylum solutions.

- Significant demographic shifts toward rural or non-urban settlement patterns contrary to infrastructurally gated migration trends.

Strategic Questions

- How can capital deployment strategies in urban infrastructure be realigned to proactively manage migration flows under climate stress?

- What new regulatory models are required to integrate migration considerations into urban infrastructure planning and approval processes?

- Which urban centers are strategically positioned to become primary migration absorptive nodes based on planned infrastructure investments?

- How might infrastructure investment-induced migration filtering reshape global urban hierarchies and geopolitical influence?

- What metrics and early warning systems are necessary to monitor the effectiveness of infrastructure as a migration governance tool?

- How could emerging financing instruments (e.g., impact bonds linked to migration outcomes) align investor incentives with urban absorptive capacity?

Keywords

Climate Migration; Urban Infrastructure; Migration Governance; Water Scarcity; Climate Adaptation; Capital Allocation; Geopolitical Stability; Humanitarian Crisis; Urban Planning; Water Management.