Our Scans

·

Biodiversity

·

Intelligence Briefing

Intelligence Briefing about Biodiversity

Critical Trends Impacting Plan International

- Accelerating biodiversity loss driven by climate change, habitat destruction, and invasive species threatens ecosystem stability and human well-being (SciTechDaily, GJSentinel).

- Technological advances, including AI-driven genetic preservation and aerial monitoring, are emerging as critical tools for biodiversity conservation and risk mitigation (TechNet, UKAuthority).

- Renewable energy development, particularly wind and solar, is expanding rapidly but introduces challenges related to waste management and ecosystem disruption (EnergyNewsBeat, EIA).

- Policy variability at national and regional levels profoundly influences conservation outcomes, especially for critical habitats such as coral reefs and forests (EurekAlert, Walmart Corporate).

Key Challenges, Opportunities, and Risks

- Challenges: Managing the environmental impact of renewable technologies’ end-of-life waste; controlling invasive species; balancing economic development with ecosystem preservation; and addressing fragmented conservation policies.

- Opportunities: Leveraging AI and remote sensing for enhanced biodiversity data; fostering youth engagement in conservation; incorporating health models like forest vet clinics to bolster ecosystem resilience; and integrating green technologies within development plans.

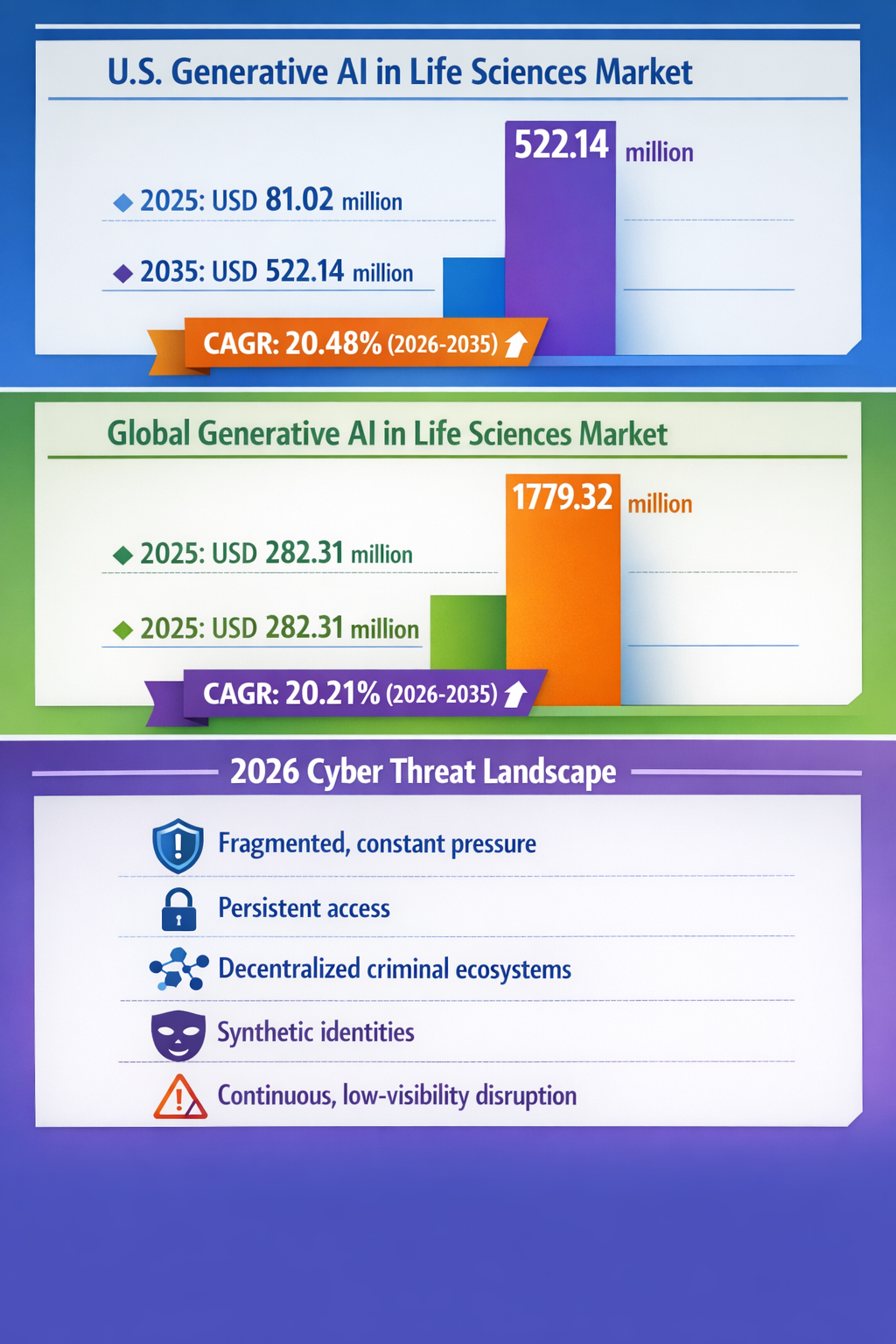

- Risks: Ecosystem destabilization due to unchecked invasive species or pollution (notably in fragile Arctic ecosystems); cyber threats disrupting environmental monitoring systems; and political shifts affecting conservation policy continuity.

Scenario Development

- Best-Case: Global adoption of unified, progressive conservation policies combined with cutting-edge AI and technological tools leads to significant restoration of biodiversity and sustainable development; renewable energy waste is effectively recycled and managed.

- Moderate Progress: Incremental advances in technology and policy stabilize key ecosystems, but localized biodiversity loss continues due to inconsistent governance and partial implementation of sustainable practices.

- Challenge Escalation: Renewable energy expansion outpaces waste management capabilities; invasive species and pollution increase, causing accelerated ecosystem degradation; cyber disruptions hamper conservation efforts.

- Worst-Case: Fragmented policies, climate change, and invasive species drive widespread ecosystem collapse; renewable energy infrastructure contributes to unmanageable waste and ecosystem harm; critical data loss due to cyber threats undermines conservation strategies.

Strategic Questions

- How could Plan International support the integration of emerging technologies to enhance biodiversity monitoring while safeguarding data integrity against cyber threats?

- In what ways could varying national conservation policies be harmonized or navigated to maximize biodiversity outcomes across regions where Plan International operates?

- How might Plan International foster youth engagement and capacity building to leverage green economy opportunities linked to biodiversity and renewable energy sectors?

- What strategies could be developed to mitigate risks associated with the environmental footprint of renewable energy’s end-of-life waste within vulnerable communities?

Actionable Insights

- Plan International could explore partnerships with technology innovators to pilot AI-driven genetic data preservation and remote monitoring methods tailored to local ecosystems.

- It could advocate for and contribute to policy dialogues aimed at standardizing biodiversity conservation regulations across borders.

- Integrating education on sustainable development and ecosystem health into youth programs could cultivate future leaders equipped to address biodiversity challenges.

- Consideration of the full lifecycle environmental impacts of renewable energy projects could guide community-based waste management solutions that align with biodiversity preservation.

Briefing Created: 25/02/2026