The Emerging Disruption of Real-World Asset Tokenization in Financial Markets

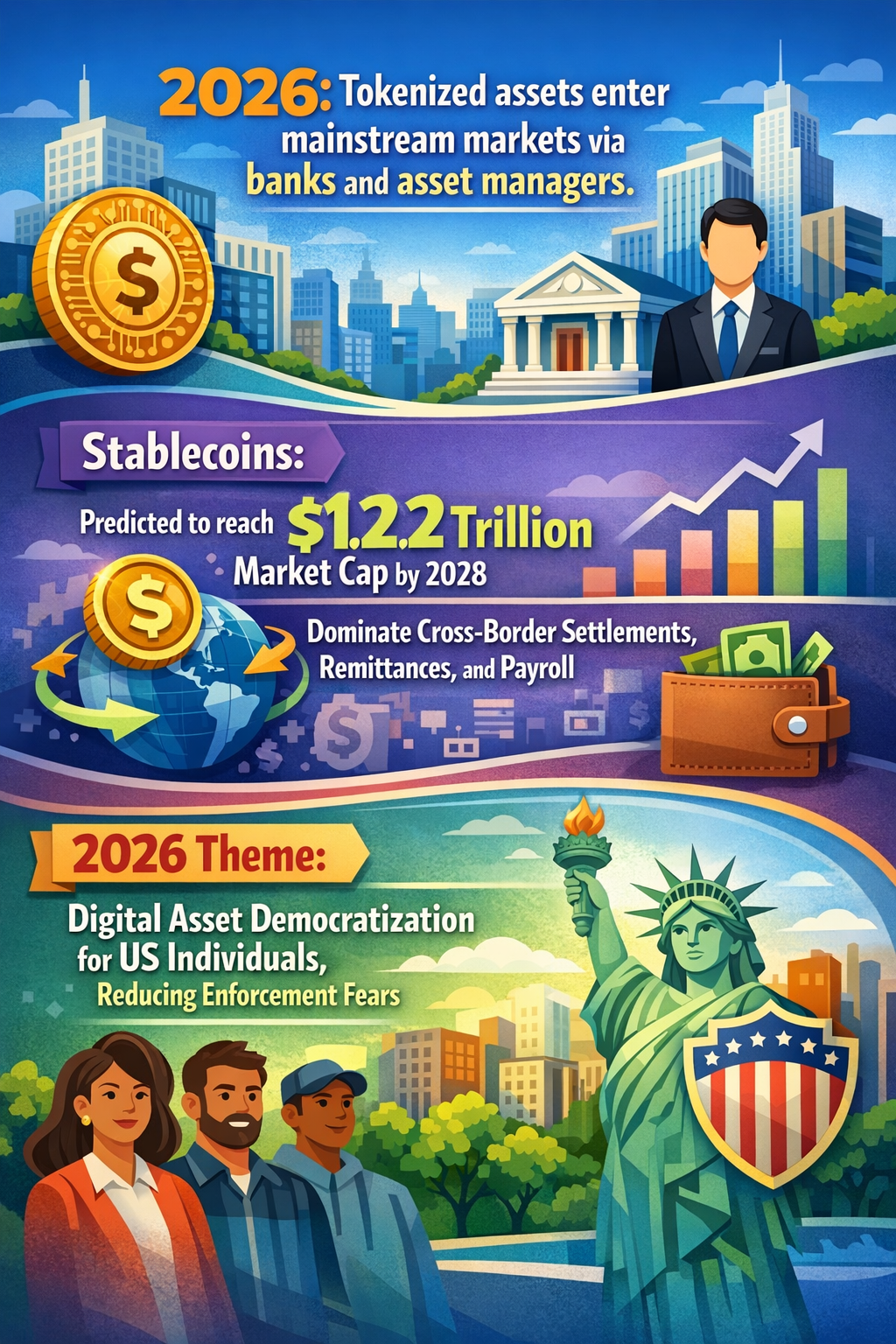

Real-world asset tokenization (RWAT) is gaining momentum as a transformative trend in finance, merging tangible assets with blockchain-based digital tokens. While tokenization itself is not new, recent legal and technological breakthroughs suggest this development could disrupt traditional asset management, banking, and beyond by 2026 and onwards. This article explores a weak yet critical signal: mainstream institutional adoption spurred by regulatory clarity, novel infrastructure, and increased interoperability, which could fundamentally reshape the ownership, transfer, and liquidity of assets across industries.

What's Changing?

Several overlapping developments are converging around the tokenization of real-world assets—physical properties, bonds, securities, and commodities—onto blockchain platforms. Key elements of this emerging change include:

- Regulatory Framework Advancements: Governments and regulatory bodies are actively crafting clearer rules for tokenized assets. For instance, the U.S. Securities and Exchange Commission (SEC) is developing guidelines for tokenized bonds and securities, signaling that these instruments may soon gain legitimacy equivalent to their traditional counterparts (Mexc.com). Similarly, the EU’s Markets in Crypto-Assets (MiCA) framework and the U.S. GENIUS Act aim to formalize stablecoins, which underpin many asset tokens, further legitimizing the ecosystem (Biometric Update).

- Institutional and Industry Adoption: Leading financial institutions and asset managers are signaling a move into decentralized finance (DeFi) and tokenized asset markets. The Depository Trust & Clearing Corporation (DTCC) recently partnered with Canton Network, a permissioned blockchain tailored for institutional issuer and custodian use cases, aiming to streamline digital asset custody and transaction processing (Mexc.com). JPMorgan analysts highlight the integration of traditional and digital assets on common platforms as a route to financial inclusion, particularly benefiting underbanked regions (Interactive Crypto).

- Emerging Infrastructure and Interoperability: Blockchain networks are evolving with cross-chain capabilities such as Optimism’s Superchain vision, enabling atomic transactions and shared ordering across multiple Layer-2 scaling solutions. This progression could position multi-chain deployments as standard for DeFi applications managing complex asset classes (Rootdata). Furthermore, frameworks like Corda and Ethereum are gaining prominence, with fintech companies choosing architectures best suited for DeFi and institutional B2B needs (Capmad.com).

- Tokenization of Physical Assets and 3D Digitization: The ongoing ability to convert physical objects into high fidelity digital assets is accelerating. Advances in 3D scanning and augmented reality (AR) technologies are creating detailed digital twins of physical goods—from real estate to advertising space—that can be tokenized and traded securely (Revopoint3D). This may unlock new asset classes in open and permissioned blockchains, bridging physical and digital economies.

- Stablecoins as Underlying Payment Infrastructure: As central bank digital currencies (CBDCs) face ongoing adoption hurdles, regulated stablecoins are poised to become the primary digital payment rails supporting tokenized assets. Financial innovators foresee stablecoins handling treasury operations, B2B payments, and global remittances, forming a backbone for asset token ecosystems (Fintech Weekly, Central Banking).

These dynamics collectively signal a shift from early experimental phases of tokenized assets toward widespread institutional adoption and integration into everyday financial operations by 2026.

Why is this Important?

This shift carries implications across several dimensions:

- Increased Liquidity and Market Access: Tokenization can fractionalize traditionally illiquid assets, lowering entry barriers for investors and enabling 24/7 global trading. This could democratize access to asset classes such as real estate, fine art, and private equity.

- Efficiency Gains and Cost Reductions: Blockchain infrastructure reduces reliance on intermediaries, potentially streamlining settlement processes and reducing overhead. The use of blockchain-based registries could improve transparency and auditability, enhancing trust.

- Regulatory Compliance Embedded in Code: Smart contracts enable programmable compliance and regulatory rules to be embedded directly into asset transactions, potentially reducing legal complexity and risk.

- Financial Inclusion Opportunities: Enabling underbanked populations to own and transact tokenized assets via digital wallets could integrate new segments into the global financial system, addressing persistent gaps in financial services.

- New Risks and Governance Challenges: The blending of traditional and digital asset systems may also introduce operational risks, cybersecurity threats, and novel regulatory challenges. The transparency of blockchain could expose private asset holdings, raising privacy concerns.

Implications

Organizations in investment, banking, regulation, and technology sectors should monitor and prepare for this transformation by considering:

- Strategic Integration of Tokenized Assets: Banks and asset managers may need to develop capabilities for issuing, trading, and custodizing tokenized assets, potentially partnering with blockchain infrastructure providers or developing proprietary platforms.

- Regulatory Engagement and Compliance Readiness: Entities should proactively engage with evolving regulations around security tokens, stablecoins, and custody, influencing policy where possible and establishing internal compliance frameworks.

- Technology Investments in Interoperable Infrastructure: Investing in multi-chain infrastructure, cross-layer protocols, and digital identity solutions will be vital to enable seamless asset token flows across ecosystems.

- Exploring New Business Models: Fractional ownership, tokenized funds, and novel financial instruments could widen product offerings and customer segments, particularly in underserved markets.

- Risk Management Enhancements: New risk frameworks will be necessary to address systemic risks, cyber threats, and operational vulnerabilities introduced by tokenized asset markets.

Governments could consider how to provide clarity that facilitates innovation while protecting investor interests. Meanwhile, technologists may explore solutions for bridging physical and digital asset veracity and interoperability.

Questions

- How can organizations effectively integrate tokenized assets into existing financial ecosystems without disrupting operational continuity?

- What standards and protocols will best support cross-chain interoperability and compliance in tokenized asset markets?

- How might fractional ownership and 24/7 trading transform investor behavior and capital allocation strategies?

- What regulatory frameworks will balance innovation with investor protection, particularly regarding custody and fraud prevention?

- How can digital identity solutions and 3D asset digitization improve trust and accuracy in representing real-world assets on-chain?

- What roles will stablecoins play as payment and settlement rails in a tokenized asset economy?

- What new risks emerge from blending physical and digital assets, and how can they be mitigated?

Keywords

real-world asset tokenization; tokenized assets; blockchain interoperability; stablecoins; digital identity; DeFi; financial inclusion; smart contracts

Bibliography

- By combining DeFi primitives, physical advertising assets, and DePIN infrastructure, Phoenix Finance and ATT Global are setting a precedent for future integrations that could further enhance the crypto economy. (DePIN Sector Sees Record Revenue Surge in January 2026)

- With a clear federal framework for payment stablecoins expected by mid-2026, 24/7 blockchain-based settlement rails will become permanent infrastructure of commercial banking. (Rewriting the Rules of Digital Banking)

- The SEC is developing rules for tokenized real-world assets, including tokenized bonds and other securities that could be issued and traded on blockchain infrastructure. / Thailand (SEC Developing Rules for Tokenized Bonds)

- To successfully tokenize digital assets, DTCC signaled last month that it will partner with Canton Network, a permissioned blockchain designed specifically for institutions. (DTCC & Canton Network Partnership)

- Optimism's Superchain vision (achieving cross-chain atomic transactions and shared ordering) is expected to become the standard for multi-chain deployment in DeFi, especially for applications requiring cross-L2 coordination. (Optimism’s Superchain Vision)

- New laws in the U.S. and the EU, such as the GENIUS Act and MiCA, are expected to legitimize stablecoins. (Identity Must be Continuous)

- By 2026, fintechs that choose the right framework (Corda for B2B, Ethereum for DeFi) will dominate emerging digital markets. (Blockchain 2026: The 5 Frameworks That Will Boost Fintech)

- Analysts at JPMorgan have weighed in, noting that the integration of traditional and digital assets into a single platform could drive financial inclusion, especially in underbanked regions. (Digital Wallets Will Hold Totality of People’s Assets)

- The next two years will be defined by how quickly physical objects can be converted into high-quality digital assets. (3D Scanning Impact on AR Growth 2026)

- Stablecoins will increasingly function as payments infrastructure, particularly in B2B flows, treasury operations, and global payouts. (Stablecoin Predictions 2026)