Oral GLP-1 Therapies: A Weak Signal Reshaping Pharmaceutical and Healthcare Markets by 2026

New developments in glucagon-like peptide-1 receptor agonist (GLP-1) drugs, particularly the upcoming launch of oral formulations, mark a subtle but significant inflection point for the pharmaceutical and healthcare industries. These advancements may disrupt diabetes and obesity treatment paradigms, pricing strategies, and insurance coverage landscapes. With oral GLP-1 therapies expected to enter the U.S. market by mid-decade, a weak signal of change could emerge as an underappreciated trend shaping future healthcare delivery, patient accessibility, and competitive dynamics across multiple sectors.

What's Changing?

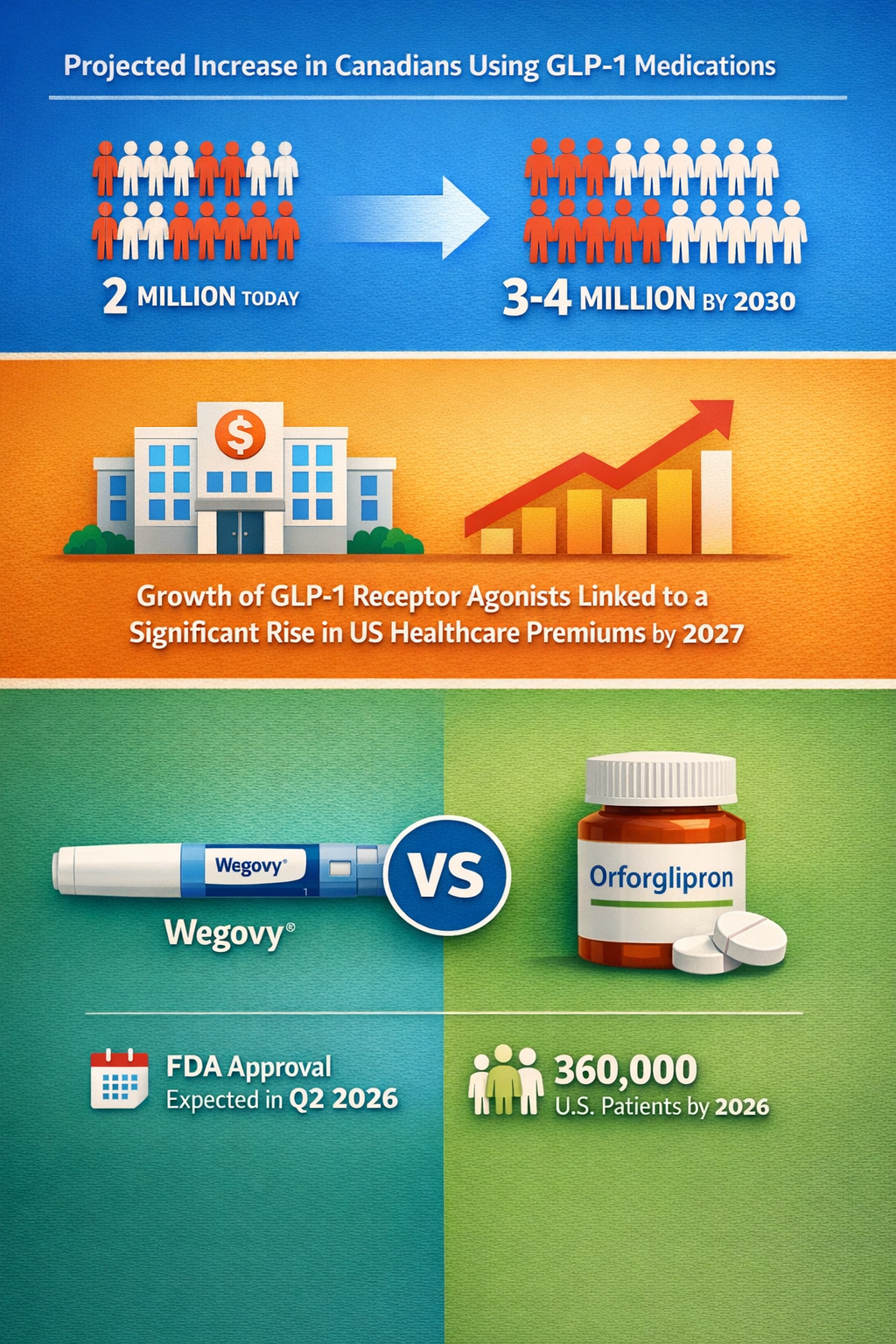

The pharmaceutical company Novo Nordisk, known for producing GLP-1 injectable drugs like Ozempic and Wegovy, has announced plans to introduce oral Ozempic tablets in the United States by the second quarter of 2026 (Rejoy Health). This transition from injection to oral delivery represents a novel development for GLP-1 drugs, which have traditionally required subcutaneous administration.

This shift aligns with Novo Nordisk's strategic pivot toward oral obesity treatments as an avenue for growth, particularly given forecasts of a sharp revenue decline with the injectable formulations in 2026 (Pharmaceutical Technology). Several factors contribute to this anticipated downturn: expected patent expirations reducing exclusivity, increasing market competition, and political pressures spearheaded by former U.S. President Donald Trump’s efforts to lower weight-loss drug prices (Business of Fashion).

An additional dimension intensifying downward price pressures comes from Medicare Part D’s plan to cap copays for certain GLP-1 weight-loss drugs at $50 per month for retirees starting in 2026. This coverage expansion for GLP-1 injections, with Federal pricing set around $245 monthly and patient out-of-pocket limits enforced (McDermott Will & Emery; Yahoo News), adds pressure on manufacturers to innovate and adjust pricing models.

Combined, these developments suggest emerging momentum toward more accessible and consumer-friendly formulations of GLP-1 therapies, which could widen patient adoption beyond previous constraints of injectable treatments. However, the industry’s reaction—whether through pricing shifts, promotional strategies, or expanded clinical indications—remains uncertain, presenting an important weak signal for strategic foresight.

Why is this Important?

The emergence of oral GLP-1 drugs could redefine treatment adherence and market penetration. Injectable medications often encounter patient resistance due to needle aversion and administration complexity. An oral option may lower these barriers, potentially expanding usage to broader populations including earlier-stage type 2 diabetes patients, prediabetics, or individuals seeking weight management outside conventional clinical contexts.

Price adjustments and Medicare policy shifts indicate growing governmental and insurer willingness to regulate and subsidize GLP-1 medications, reflecting recognition of their public health impact, especially given the obesity and diabetes epidemics. This could alter competitive dynamics by facilitating increased access while compressing profit margins for innovators.

The anticipated revenue dip at Novo Nordisk portends industry-wide disruption. Companies reliant on patent-protected GLP-1 injectables may face urgent pressure to diversify portfolios toward oral and next-generation therapies, alternative delivery mechanisms, or adjacent metabolic condition treatments.

Furthermore, these changes may trigger knock-on effects beyond pharmaceuticals, including:

- Digital health and monitoring technologies: Enhanced demand for compliance tracking and real-time glucose monitoring to optimize oral drug effectiveness.

- Pharmacy and retail landscapes: Shifted prescription models potentially favoring over-the-counter or simplified refill systems.

- Health insurance and reimbursement: Novel payment schemes may emerge, balancing wider access with cost containment.

Implications

From a strategic standpoint, the anticipated rollout of oral GLP-1 therapies anticipates a complex interplay of innovation, regulation, and market response carrying broad implications. Decision-makers across pharmaceutical companies, healthcare providers, policymakers, and insurers should consider the following:

- Pharmaceutical innovation and competition: Companies might intensify R&D investment to develop oral or other patient-preferred formulations, exploring novel metabolic targets or combination therapies to maintain competitive differentiation.

- Pricing strategy evolution: Manufacturers may need to rethink traditional premium pricing models in light of Medicare copay caps and political initiatives aiming to expand equitable drug access.

- Health system adaptation: Providers could anticipate increased uptake and build care pathways around earlier intervention using oral GLP-1 therapies, integrated with lifestyle modifications and digital support tools.

- Insurance product redesign: Payers may redesign formularies and payment models emphasizing value-based care and adherence incentives that leverage easier-to-administer oral medications.

- Patient engagement and education: Health systems and advocacy groups must prepare for potential shifts in patient perceptions and expectations around chronic disease management, emphasizing convenience and long-term benefits.

Cross-sector collaboration could become crucial to manage these emerging changes smoothly, balancing the interests of pharmaceutical innovation with public health goals and affordability.

Questions

- How might pharmaceutical companies balance R&D investment between injectable and oral GLP-1 therapies amid patent cliffs and pricing pressures?

- What frameworks can policymakers develop to encourage innovation while ensuring equitable access to novel medications that may broaden treatment eligibility?

- How will healthcare providers restructure diabetes and obesity management programs to incorporate oral GLP-1 options effectively alongside lifestyle and digital interventions?

- What insurance designs or reimbursement models could emerge to incentivize patient adherence and maximize therapeutic outcomes with changing drug delivery forms?

- Could the success of oral GLP-1 treatments spur similar delivery innovations in other chronic disease medications, potentially disrupting wider pharmaceutical categories?

Keywords

Oral GLP-1 Therapies; Novo Nordisk; Type 2 Diabetes; Medicare Drug Pricing; Pharmaceutical Pricing Reforms; Obesity Treatment; Drug Patent Expiry

Bibliography

- Novo Nordisk has indicated that Ozempic tablets will launch in the United States in Q2 2026. Rejoy Health. https://www.rejoyhealth.com/blog/ozempic-pill-approved-by-fda-what-the-oral-semaglutide-tablets-mean-for-type-2-diabetes-in-2026

- The maker of Wegovy and Ozempic has predicted a sharp drop in revenues in 2026, owing to a push by Donald Trump to lower US weight-loss drug prices, rising competition and the loss of key patent protections. Business of Fashion. https://www.businessoffashion.com/news/beauty/novo-nordisk-predicts-sharp-revenue-decline-2026/

- Some retirees enrolled in Medicare Part D plans will see their GLP-1 weight-loss drug prices capped at $50 per month. Yahoo News. https://www.yahoo.com/news/articles/medicare-changes-2026-every-retiree-100400333.html

- Medicare pricing for GLP-1 injections will be set at $245 per month, with patient copays capped at $50 per month. McDermott Will & Emery. https://www.mwe.com/insights/glp-1-coverage-expansion-under-medicare-what-digital-health-companies-need-to-know/

- An avenue for growth for Novo will likely be in the oral obesity treatment space. Pharmaceutical Technology. https://www.pharmaceutical-technology.com/news/novo-nordisk-shares-tumble-18-after-2026-sales-dip-warning/