The Emerging Disruption of Oral GLP-1 Medications in Healthcare and Beyond

Glucagon-like Peptide-1 (GLP-1) receptor agonists are expected to reshape the healthcare landscape over the next decade, propelled by a novel shift from injectable therapies to oral medications. This shift represents a weak signal of change with disruptive potential far beyond obesity and diabetes treatment. As accessibility and affordability increase alongside new formulations, multiple industries—from pharmaceuticals and insurance to retail and wellness sectors—may experience profound effects. Understanding this emerging trend will aid strategic planners in anticipating systemic transformations and identifying opportunities and risks across sectors.

What’s Changing?

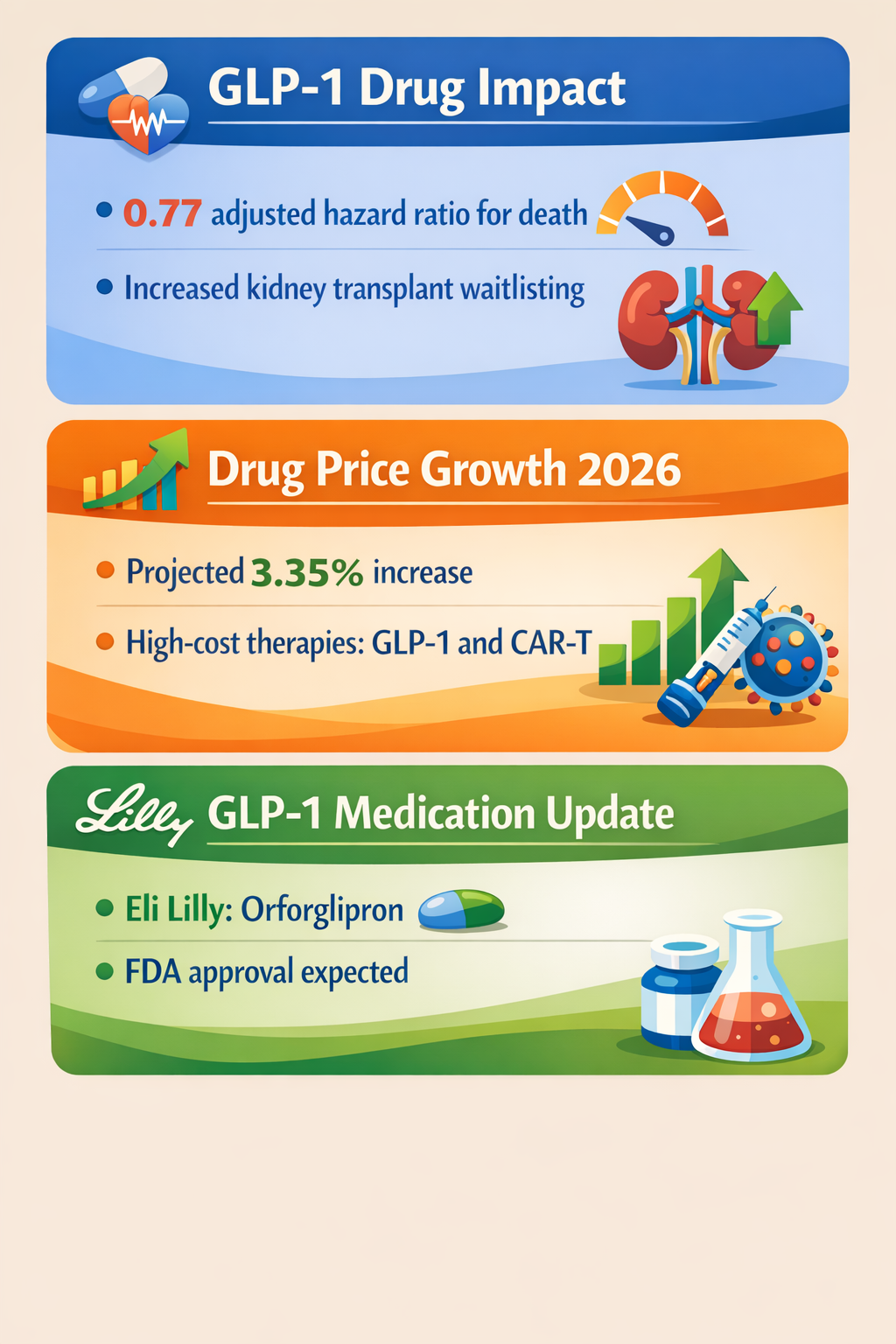

GLP-1 receptor agonists have gained recognition primarily for managing type 2 diabetes and obesity by regulating appetite and improving insulin sensitivity. Traditionally, these drugs required injections, limiting convenience and patient adherence. However, 2026 is poised to be a landmark year with the FDA approval and market launch of oral GLP-1 medications like Novo Nordisk’s Wegovy pill and Eli Lilly’s anticipated orforglipron pill (Newswise, ABC News).

This development is part of a broader industry shift. Novo Nordisk and Eli Lilly, leaders in the GLP-1 space, are fiercely competing to dominate the oral formulation market. Analysts forecast this segment could grow to a $100 billion industry by the 2030s (CNBC).

Several catalysts underpin this emerging trend:

- Improved Patient Accessibility and Convenience: Oral medications remove the stigma and inconvenience of injections, making GLP-1 therapies more appealing across wider demographic groups (The Slimming Clinic).

- Regulatory Approvals and Expanding Markets: Regulatory bodies in the US, UK, and Canada are approving oral GLP-1 drugs, expanding geographic and demographic reach (Mirror UK, Vernon Matters).

- Increasing Drug Affordability and Generic Competition: Generic production of blockbuster drugs like Ozempic emerges, potentially lowering prices and enabling broader adoption (Vernon Matters).

- Shift in Prescribing and Insurance Models: Medicare payment models and private insurers may modify coverage to accommodate increasing demand for GLP-1 therapies (ACHI).

- Consumer Trends and Retail Distribution: Retail outlets like Costco and digital health platforms such as Noom are entering the GLP-1 distribution space, normalizing and commoditizing the medications (Bakery & Snacks).

Projections indicate the number of global GLP-1 users could surpass 40 million by 2029, up from an estimated 2-4 million in Canada alone today (Retail Insider). This scale of usage underscores a potential systemic shift, transforming how metabolic and weight-related health conditions are managed.

Why is this Important?

The rise of oral GLP-1 therapies could rewrite the economics and experience of chronic disease treatment. If convenience and accessibility improve adherence, overall patient outcomes may improve, reducing downstream healthcare costs from diabetes and obesity related complications. These changes might influence premiums, reimbursement models, and cost structures across healthcare systems (AJMC).

Furthermore, with easier access to effective weight management drugs, societal perceptions around obesity could evolve, potentially reshaping public health policy and resource allocation. However, this normalization might also trigger debates on long-term drug dependence, ethical use, and allocation equity.

The influx of oral options may pressure traditional pharmaceutical supply chains to pivot rapidly. Retail and telehealth channels could become primary distribution points, blurring industry boundaries between healthcare, consumer goods, and technology sectors. This convergence may disrupt incumbent players unfamiliar with such cross-sector ecosystems.

In addition, novel payment demonstrations and insurance models designed around these drugs suggest that policy innovation is keeping pace with therapeutic innovation. For governments and private insurers, these disruptions could represent both cost containment challenges and opportunities for population health improvements.

Implications

Strategic planners in pharmaceutical companies, healthcare providers, payers, and policy organizations should anticipate cascading effects from the oral GLP-1 wave. These effects include but are not limited to:

- Innovation in Drug Development and Delivery: Greater focus on oral peptide therapies could open avenues for other injectable drugs to transition to more user-friendly administration forms.

- Reconfiguration of Healthcare Access and Delivery: Increased self-administration and retail distribution might require new models for patient monitoring, digital adherence support, and safety protocols.

- Insurance and Reimbursement Evolution: Payers might redesign coverage policies to balance short-term drug costs with long-term savings from reduced comorbidities.

- New Market Entrants and Partnerships: Technology and retail companies may find new business models by integrating GLP-1 drugs into broader wellness programs, potentially challenging traditional healthcare incumbents.

- Socioeconomic and Ethical Considerations: Widespread accessibility might exacerbate disparities if costs remain prohibitive for underserved populations even as demand surges. Equity in treatment access will be a significant concern.

Preparations for this coming shift might include investments in data-driven patient management platforms, proactive policy engagement around reimbursement frameworks, and cross-sector collaborations to deliver integrated health and wellness experiences.

Questions

- How will the widespread adoption of oral GLP-1 drugs reshape patient engagement and adherence in chronic disease management?

- What new regulatory frameworks will emerge to balance rapid commercialization with safety monitoring in retail and direct-to-consumer distribution?

- How might insurance models evolve to reflect shifting cost-benefit dynamics driven by increased use of these drugs?

- Which new partnerships will form across pharmaceutical, technology, and retail sectors to capitalize on the changing medication landscape?

- What strategies can governments and health systems implement to ensure equitable access and mitigate socioeconomic disparities in availability?

Keywords

GLP-1 medications; oral drug formulations; chronic disease management; healthcare accessibility; pharmaceutical innovation; health insurance models; retail healthcare distribution; metabolic health.

Bibliography

- First GLP-1 weight loss pill approved: Novo Nordisk's oral Wegovy is expected to be widely available, with another pill from Eli Lilly likely later in 2026 - offering a needle-free option many patients prefer. Newswise. https://www.newswise.com/articles/why-2026-will-reshape-access-to-glp-1-weight-loss-drugs

- The pharmaceutical leader is expected to dominate 2026 through its GLP-1 franchise. Peter Fisk. https://www.peterfisk.com/2026/01/my-top-10-business-predictions-for-2026-from-agentic-efficiency-to-human-authenticity-circularity-advantage-and-sanaenomics-to-the-iphone-fold-and-sony-afeela-ev/

- Drug companies in Canada are allowed to make lower priced generic versions of the blockbuster drug Ozempic as of next week, but experts say patients should not expect it to be available for at least a few months. Vernon Matters. https://vernonmatters.ca/2026/01/02/companies-can-make-generic-ozempic-as-of-next-week-but-dont-expect-to-get-it-soon/

- CMS plans to implement a GLP-1 payment demonstration model - a short-term initiative that will serve as a bridge to the BALANCE model - in July 2026 for participating Medicare Part D plans. ACHI Newsroom. https://achi.net/newsroom/trump-administration-announces-new-voluntary-payment-model-for-weight-loss-drugs/

- GLP-1 weight-loss drugs like Ozempic and Mounjaro are expected to become cheaper, more accessible, and more normalized by 2026. Vocal Media. https://vocal.media/journal/the-economist-s-2026-cover-prediction-pattern-or-power-play

- There will be 40 million global GLP-1 users by 2029, while availability continues to expand through retailers like Costco and programs such as Noom's GLP-1Rx. Bakery & Snacks. https://www.bakeryandsnacks.com/Article/2026/01/02/10-consumer-appetite-trends-resetting-bakery-snacks-in-2026/

- Lilly is getting closer to finishing its clinical trials on what could be the most powerful GLP-1 drug yet, called retatrutide. NBC News. https://www.nbcnews.com/health/health-news/weight-loss-drug-prices-2026-glp-1-pills-trumprx-what-expect-rcna249520